Sitting on Cash or Cashed Out of the Stock Market. What to Buy… a Single Family Home or Invest in Real Estate Syndications?

Let’s take a deep-dive into two paths a young family might take: saving up to $200,000 to buy a home versus renting a home and investing that $200,000 in real estate syndications.

We’ll examine the math behind the two scenarios, as well as the potential risks and liabilities of each.

Ready? Let’s go.

Scenario 1 – Conventional Wisdom – Save Up to Buy a Home

Let’s start with the conventional wisdom, which is to save up money for a down payment, then purchase a home.

Let’s say our fictional couple, Jack and Jill, have just gotten married, and they’ve been told that they should settle down, buy a house, maybe get a dog, then have some kids.

Jack and Jill knew this day was coming, so they’ve been saving up.

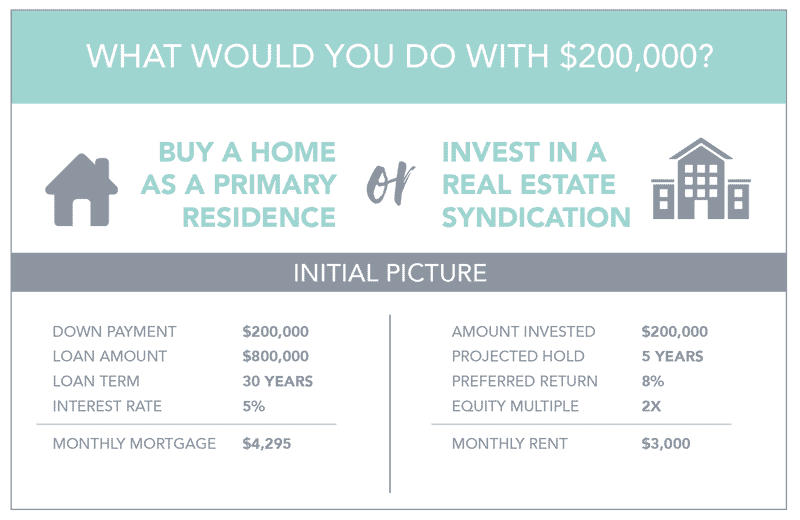

After looking at a few homes, they find the perfect three-bedroom home in a decent neighborhood and put it under contract for $1 million. They plan to put in 20%, or $200,000, as a down payment. (For simplicity’s sake, we’ll keep closing costs out of this scenario.)

They secure a loan for $800,000 at 5% interest with a 30-year amortization.

Everything goes smoothly, and Jack and Jill soon have the keys to their new $1 million home in hand.

One month later, they get a mortgage bill in the mail for their first month’s payment: $4,295.

They both have pretty well-paid tech jobs, so this mortgage payment is well within reason for them.

In a few years’ time, Jack and Jill find out they’re expecting their first child. Then their second. The house is filled with laughter and general merriment, with the occasional screams of “Mom, she hit me!” But what happy family doesn’t experience their fair share of sibling drama, right?

About five years in, they realize the roof needs to be replaced. A couple years after that, their hot water heater goes out. And then they discover foundation issues. Uh-oh.

But, because both Jack and Jill are well-paid professionals, they’re able to cover the costs of the unexpected repairs.

Ten years after they buy the home, Jack and Jill realize they’re out-growing what once seemed like such a spacious home. They’ve got two tweens and a labradoodle in the house now, and more space is in order. Stat.

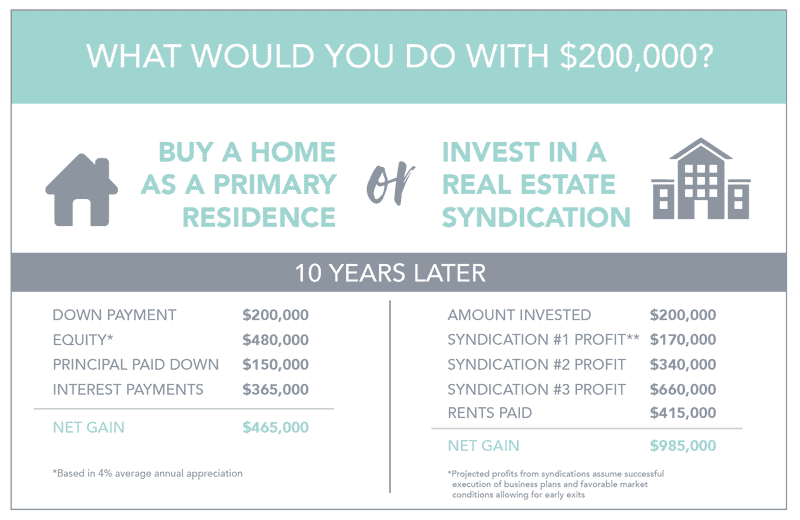

Over the ten years they’ve owned the house in this hot market, the appreciation in their area averaged, let’s say, 4% annually. That means that their house is now worth about $1,480,000, which means that Jack and Jill have gained about $480,000 in equity over those ten years.

But of course, that’s not all. Jack and Jill have diligently paid their mortgage every month, which has helped to pay down the principal on their $800,000 loan.

Over the ten years, they’ll have paid about $515,000 in monthly mortgage payments ($4,295 per month for 120 months). Of that, roughly $150,000 will have gone toward their principal, which means they still have about $650,000 remaining on their loan balance.

That also means that they’ve paid about $365,000 in interest to the bank over the years. Ouch!

If they sell now, they will receive their original $200,000 down payment back, $480,000 in equity from appreciation, and $150,000 in principal that they’ve paid down over the years.

That means that they’ll end up with about $830,000 in their pockets at the end of the day.

Well, they’ll likely put a good chunk of that toward the dream home that they’re buying next, but, you get the point.

$830,000. That’s a lot of money, especially when you think about the $200,000 that they started with.

Surely that means that conventional wisdom is right and that this is indeed the best path…right?

Scenario 2 – Bucking Conventional Wisdom – Rent a Home and Invest Instead

Jill has always had a bit of a rebel streak inside her. Her parents wanted her to go to medical school, but she ended up majoring in art history instead.

Let’s rewind these ten years and see what would have happened if Jack and Jill had taken a different path, a path that few people ever dare to even consider.

Jill has never liked the idea of being saddled with a mortgage. So, when it came time to “settle down,” she and Jack weren’t sure that they wanted to sink the $200,000 they’d worked so hard to save up into a house. So, they decided to rent a home instead of buying one.

They found a terrific three-bedroom apartment near public transit for $3,000 per month.

Because they were renting a home, they didn’t have to pay for any maintenance costs or HOA fees, and they liked that.

They took the $200,000 that they’d saved up for the down payment and invested that money into a real estate syndication instead.

The syndication was for an apartment community in a fast-growing neighborhood of Dallas, Texas. The syndication came with a preferred return of 8% per year, and an estimated equity multiple of 2x over a projected 5-year hold period (i.e. they could feasibly double their money in five years, when counting both the cash flow distributions and the profits at the sale of the asset).

Three years later, when Jill was pregnant with her first child, they found out that the renovations on the multifamily syndication were complete, and that the sponsor team would be selling the asset early. By the end of year three, their first child is born, and they receive their original $200,000 investment back. Oh, and they’ve made $170,000 in profits from the syndication they invested in.

Because they love both their apartment and the experience of investing in the syndication, they decide to continue renting and reinvest the $370,000 into another syndication with the same sponsor team.

Four years later, that second syndication successfully completes their reposition and is able to sell the property and double Jack and Jill’s original $370,000. Now, Jack and Jill have $740,000.

At this point, they have a four-year-old and another baby on the way. They love investing in syndications so much that they’ve told all their friends about it. They take their $740,000 and reinvest it.

Three years later (which is now ten years since they invested in that first syndication) they end up with $1.4 million.

Now of course, we can’t forget the rents that Jack and Jill have been paying every month. The rents that their parents told them they were “throwing away every month” and that they’d never get back.

Over those ten years, assuming an annual rent increase of 3% per year, they will have made about $415,000 in monthly rent payments. And no, their landlord isn’t about to write them a check to return any of that.

Even still, when we factor in the profits from their syndication investments, are those rent payments they’re “throwing away” really as bad as society makes them out to be?

Comparing the Math

In both cases, Jack and Jill started out with $200,000 to put into something. In scenario 1, they chose to use the $200,000 as a down payment for a house. In scenario 2, they chose to invest that money into a real estate syndication instead.

So, how do the two scenarios compare? Let’s take a look.

Scenario 1

Started with

$200,000

Equity after 10 years

$480,000

Principal paid down after 10 years

$150,000

Interest payments over 10 years

$365,000

Net gain over 10 years

$465,000

—

Scenario 2

Started with

$200,000

Profits after first syndication exited in year 3

$170,000

Profits after second syndication exited in year 7

$340,000

Profits after third syndication exited in year 10

$660,000

Rent payments over 10 years

$415,000

Net gain over 10 years

$985,000

nWow. I did not see that one coming. Seriously. I mean, I set out to write this article to show you that real estate syndications might be on par with buying a home, or perhaps a slight bit better, but even I did not expect this big of a discrepancy. (Hang on, let me just double check my math…hmm, carry the 1…yup yup, it all looks right.)

This means that if Jack and Jill were to decide to go against conventional wisdom and invest their money in a real estate syndications, while continuing to rent, over the course of ten years, they could end up with roughly $520,000 more than if they were to buy a home and make the mortgage payments.

Over $500,000 more. Let’s just let that sink in for a minute.

$500,000 over 10 years is an average of $50,000 a year, which essentially means that Jack and Jill added a third income earner to their household. All without having to do any work. That’s the power of passive income.

Assumptions and Other Considerations

Of course, all this math is just on paper, and it’s based on a number of assumptions. Here are a few of the big assumptions I made:

1. Assumption: Home Appreciation Rate

I’m assuming an annual home appreciation of 4% over ten years. It’s possible that, in a hot area like the San Francisco Bay Area, the average appreciation could top that. But of course, that’s not a guarantee. Home prices could just as well dip down and appreciation could slow, no matter what the historical data says.

2. Assumption: Syndication Performance

I’m also assuming that the syndications are led by strong teams that are able to execute on their business plans and meet or exceed their projections. And that the market holds fairly decent, allowing these deals to cycle through in a timely manner. Both of these factors can be big question marks, especially when you’re first starting out investing in syndications.

That’s why we work so hard to make sure the teams we’re investing with are strong operators with proven track records, conservative underwriting, and multiple exit strategies.

3. Consideration: Huge Home Loan

Another big aspect to consider is the huge loan that Jack and Jill would be taking on in scenario 1, if they were to buy a home. That $4,295 per month payment seems doable when both Jack and Jill are happily employed and have no kids.

But if a recession were to hit and one of them were to lose their job, or Jack’s father got sick and he had to take some time off to take care of him, or any number of other unexpected situations were to come up, they might struggle to make that monthly payment, which could then lead them to default on their mortgage and possibly lose their home.

When you factor in that huge loan, you can start to see that buying a home is really more of a liability than the asset mainstream media keeps telling us it is.

4. Consideration: Liability

Consider, on the flip side, scenario 2, in which Jack and Jill invest their $200,000 into a real estate syndication instead. They take on no loan themselves and are not liable to lose any more than that original $200,000. They needn’t make any additional payments on that investment. Instead, that investment is making money for them. It’s a true asset.

5. Consideration: Taxes

I didn’t even mention tax benefits that come with investing in a real estate syndication, which really put it over the top.

Conclusion

I’m going to borrow Apple’s tagline here: Think different.

Please don’t take any of this as investment advice. For one, I’m not authorized to advise you on your investments, nor am I trying to do so.

I merely wanted to show you two different scenarios. One that follows the traditional narrative that we’ve been taught all our lives. And an alternative that most people have never even dared consider. One that comes with a huge liability. And one that is a true asset.

At the end of the day, going against conventional wisdom is really difficult.

You have to be really sure that you believe in the path you choose, because people will question your choices at every turn.

My goal in diving into these two different scenarios with you was simply to lay the groundwork, to plant the seed, and to show you that an alternative exists. The hard decision of choosing whether to follow or buck against conventional wisdom is still yours to make.

Regardless, whether you choose to buy, rent, invest, or take on a hybrid approach, I hope your home is filled with the laughter and merriment that fill Jack and Jill’s fictional home. That, and maybe the occasional yell and cry too. You know, to keep things interesting.

More about the author: Alex Kholodenko

Alex is a Managing Partner at Wealthy Mind Investments.