How To Stop Trading Your Time For Money And Start Creating Passive Income

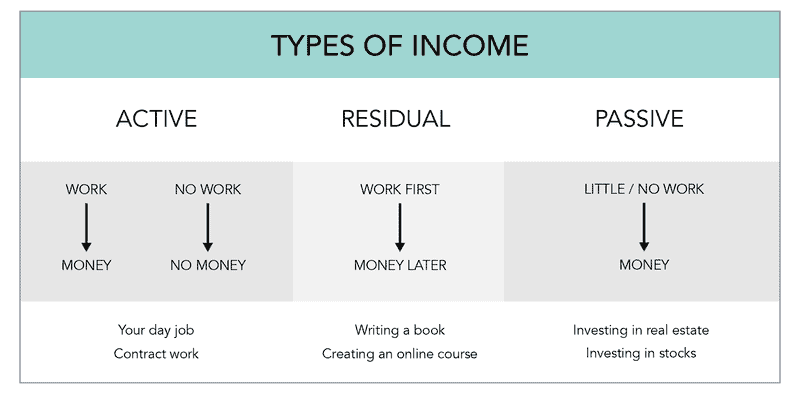

Now, let’s return to our hypothetical job loss scenario. Let’s say that you’d built multiple streams of passive income while you were fully employed. Your salary was $5,000 per month, and your passive income brings in $3,000 per month.

Sure, now that you’ve been laid off, your total monthly income now drops from $8,000 to $3,000, but the key is, you still have money coming in. While it may not be enough for that daily five-dollar latte, it can slow the burndown of your emergency fund.

And if you were really savvy and built up $5,000 per month in passive income, then you would have been financially free, meaning you don’t need to work but could instead choose to work.

Financial freedom is the ultimate dream, and passive income is the vehicle that will get you there.

Investing in Stocks vs. Real Estate

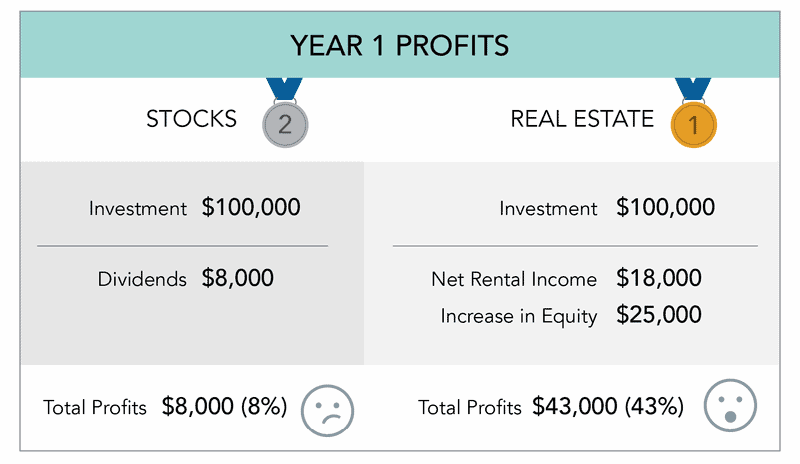

At this point, you might be thinking, well, I’ve got a good amount of money in stocks and mutual funds, and they generate passive income, right?

Well, yes, that is true. Historically, the stock market returns about 8% annually. So if you invest $100,000, you would receive roughly $8,000 per year in dividends.

But wait, $8,000 a year? That’s only $667 per month. I thought we were talking about $3,000 per month.

To reach $3,000 per month, that would be $36,000 per year, which would be 8% of…calculator please…$450,000. So you would need $450,000 worth of stocks to get an annual payout of about $36,000.

Not bad, but we can do better. How? Let’s look outside of Wall Street, toward Main Street. Yes, I’m talking about investing in real estate.

Here’s the difference real estate can make. With that same $100,000, you could buy a $400,000 rental home. How? And this is where the main differentiator between stocks and real estate comes in.

The bank brings $300,000 to the table.

That’s right, you put in 25%, the bank puts in 75%, and guess who gets 100% of the returns? You guessed it, they go right into your pocket.

A $400,000 rental home renting for $3,600 and a mortgage of $2,100 per month would net you $1,500 per month, which is half of our hypothetical $3,000 per month in passive income. So theoretically, you could invest $200,000 in $800,000 worth of rental homes and be at your $3,000 of passive income per month mark.

And, this doesn’t even count the appreciation of your homes. Nationally, the average annual appreciation is about 5%, which means you’re building about 5% equity in your homes each year. If you had a $400,000 rental home appreciating at 5% per year, while simultaneously paying down the amount you owe the bank (remember, your tenants, not you, are doing that through the rent they’re paying), in just one year, you would have gained about $25,000 in equity.

Altogether, the $1,500 per month in net rental income comes out to $18,000 per year. Combine that with the $25,000 in additional equity, and you have a one-year return of $43,000, or 43% on your $100,000 investment.

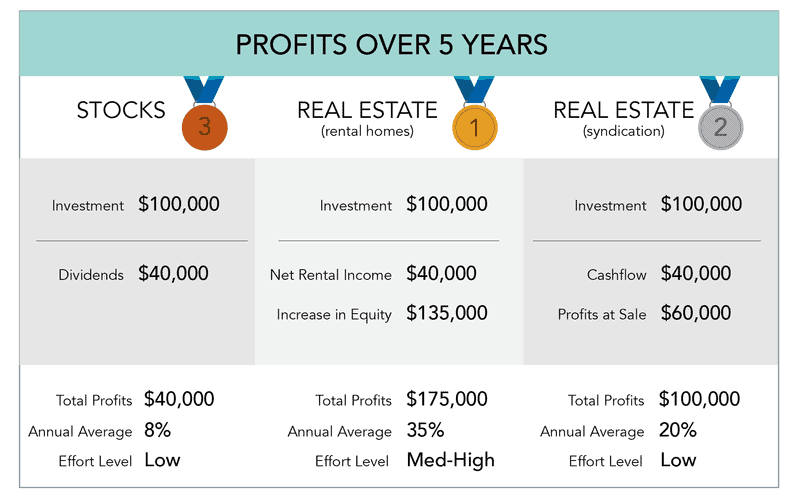

But I Don’t Want to Be a Landlord

Okay okay, I get it. The numbers look ah-mazing, but then you think about the realities of being a landlord – tenants, toilets, and termites. There’s nothing to bring your feet back to the ground like thinking about broken toilets at 3am in the morning.

Sure, you could get a property manager, but they’ll want to take a chunk of your profits. You’ll still need to be involved in major decisions, and you’ll have some additional costs in maintenance and repairs. You know, when that washer and dryer break down for the third time in two years (yes, this happened to us), or when you need to repair that cracked foundation or leaky roof. #bigbucks

Luckily, there’s another option.

What if you could still leverage all the benefits of investing in real estate, but without having to deal with a single tenant?

This is what passive real estate investments are all about. They’re sometimes referred to as crowdfunded real estate, real estate syndications, or group investments.

Here’s how it works. A small group of people , we’ll call them the sponsor team, want to acquire and operate a piece of real estate, like an apartment building. They get together and put just such an apartment building under contract.

Let’s say the apartment building costs $20 million, which would make the down payment roughly $5 million (25% of the total cost).

The sponsor team can put down $500,000 altogether. Hmm, seems they’re a bit short. So where do they get the rest of the $4.5 million? That’s where you come in.

You, and a bunch of other passive investors, can invest your money with this sponsor team and in this apartment building. You still get the benefit of leveraging a bank loan, but you don’t have to deal with any tenants, inspection reports, or seller negotiations. You just invest your money, then start getting payouts. #winwin

If you invest $100,000 in a passive real estate syndication, you would likely get around $8,000 per year (8%). Not too different from the stock example above.

However, the main difference comes in the sale of the asset. Typically, these types of investments will hold the asset for around 5 years. This gives the sponsor team a chance to improve the units, and for the value of the building to appreciate.

After 5 years, upon sale of the building, you get a check for $160,000 ($100,000 of your original investment amount, plus $60,000 in profits). This, in combination with the passive income of $8,000 you’ve been receiving each year (or $40,000 altogether), comes out to $200,000.

This means that in 5 years, you will have doubled your original investment from $100,000 to $200,000, an average annual return of 20%.

At the end of the day, any passive income is better than none. Putting all your financial eggs into one basket (i.e., your job) is a very risky proposition indeed, as that source of income could disappear in an instant, leaving you high and dry.

However, if, while you’re working your job, you’re able to create some passive streams of income, whether through investing in stocks, real estate, or otherwise, you’ll be ready if and when that day ever comes.

And if this has piqued your interest and you’d like to learn more, I highly recommend this little purple book, and joining the Wealthy Mind Investor Club to learn about passive real estate investment opportunities.

More about the author: Alex Kholodenko

Alex is a Managing Partner at Wealthy Mind Investments.