Exclusive Commercial Real Estate Investments for Accredited Investors

Wealthy Mind Investments both acquires and manages its own medical real estate deals and selectively partners with experienced multifamily Operators, leveraging integrated acquisition, finance, asset, and construction management capabilities to deliver strong, risk-adjusted returns.

300 +

Investors

50 +

Properties Acquired

20 k+

Units

2 B+

In Assets Acquired

Our Assets

Healthcare Real

Estate Fund

Location:

– FL and OKC

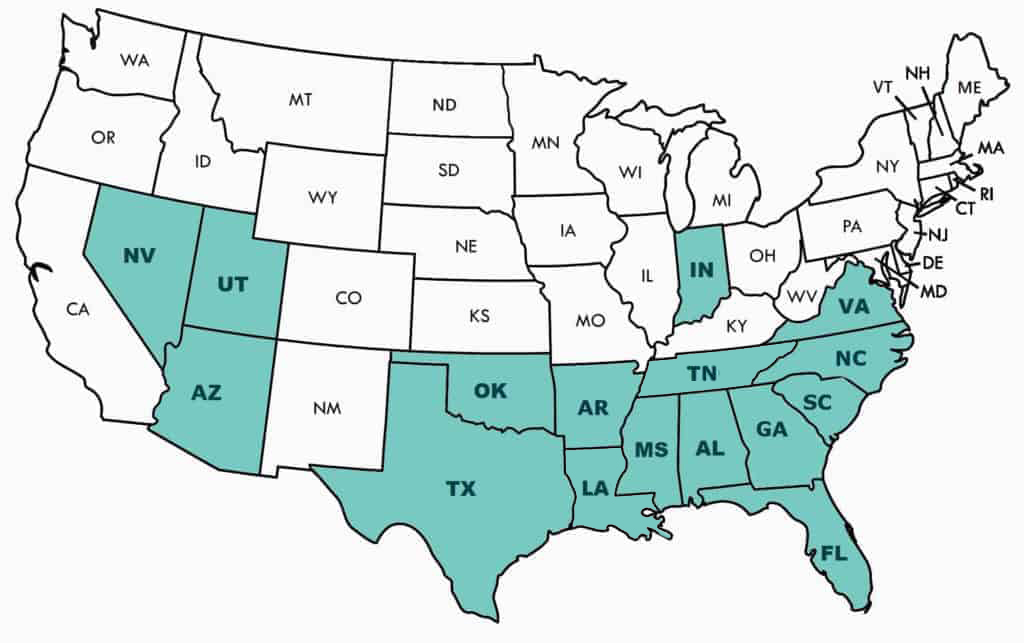

Southeast Portfolio

Location:

Units:

– 7 States

– 2744

Carolina Portfolio

Location:

Units:

– NC, SC, OKC

– 1203

Sunbelt 12 Portfolio

Location:

Units:

– TX, AR, MS

– 659

Transcoastal 21 Portfolio

Units:

Location:

– 4014

– 7 States

Tides

.

Location:

Units:

– Phoenix, AZ

– 316

Onnix

.

Location:

Units:

– Tempe, AZ

– 659

Villa at

Fort Mill

Location:

Units:

– Ft. Mill, SC

– 144

Hawthorne at

Lake Norman

Location:

Units:

– Moorseville, NC

– 232

Start Your Real Estate Investment Journey

Are you ready to build wealth and create the life you want for yourself and your family? Start today.

Join our Investor Club and set up a call with Alex or Ashish to discuss your investment goals. Our investment opportunities fill up quickly, so don’t miss out!

Free eBook:

How to Build Wealth and Create Financial Freedom By Investing in Real Estate Syndications

Discover how you can create impactful wealth and passive income through the power of real estate investing and private equity.